Stride Briefing: Fourth Edition

Dec 7, 2022

· 3 min read

The Stride Briefing is the easiest way to keep abreast of all things Stride! On a bi-weekly basis, the Briefing will concisely inform you of: recent Stride events, future Stride events, and provide current stats on Stride’s various Osmosis liquidity pools. The Stride Briefing will also serve to get new-comers up to speed.

Briefing #4, let’s go!

What is Stride?

Stride is a Cosmos-wide liquid staking provider. Using Stride’s liquid staking, you can earn staking rewards from Cosmos proof-of-stake tokens without having to stake them. Since your tokens remain liquid, you can deploy them in DeFi. This means you no longer have to choose between staking yield and DeFi yield. Thanks to Stride, you can have both at once.

Tokens supported: ATOM, OSMO, JUNO, STARS

Have questions? Check out Stride’s thorough FAQ, or join the Stride Discord.

Notable Recent Happenings

The Great STRD Airdrop:

The much-anticipated STRD airdrop was a huge success! Stride airdropped 4M STRD to over 340,000 unique addresses. Since the airdrop, there has been a huge uptick in users interacting with the protocol. Remember, in three months unclaimed STRD will be clawed back and redistributed to all original recipients. In other words, if you were part of the first drop, you'll get the chance to claim more STRD in the future.

Airdrop for stATOM LPers:

Speaking of airdrops, the HARBOR airdrop for stATOM LPers for Osmosis liquidity pool is claimable. If you’re eligible, be sure to check it out.

stOSMO incentives:

The Osmosis community approved permanent incentives for the stOSMO pool. The pool was already incentivied with STRD, but now it also receives OSMO incentives. Every little bit helps!

Stride’s YouTube channel:

Stride has launched its own YoutTube channel! Several informative videos about Stride and Stride’s partnerships have been uploaded. Expect a continual stream of content in the future.

STRD to be part of IBCX

The IBCX index token announced its composition, and STRD was included. According to the proposed composition, STRD will make up 2.8% of the basket of Cosmos tokens. STRD is the youngest token in the basket. This shows that, though young, Stride is already a significant Cosmos project.

Cosmos Hub Validator Set Selection Process:

The Stride community is currently in the process of selecting its Cosmos Hub validator set. Validator applications have been collected, and the advisory council is now at work evaluating the validators. Expect a text proposal for the new validator set next week, followed by an on-chain vote.

Up-coming Things

Demex integration:

Demex will be the first DeFi application outside of Osmosis to support Stride's stTokens. Next Monday, Demex will support lending and borrowing of stATOM and stOSMO, as well as liquidity pools.

Umee integration:

Speaking of integrations, Umee will likely be enabling lending / borrowing support for stATOM sometime in December.

Stride on-boarding Injective:

There have been some delays with the on-boarding of Injective. But it will happen! Once stINJ is launched, there will be a liquidity pool on Helix (Injective’s premier DEX), as well as a customary airdrop to INJ stakers.

Stride Liquidity Pools Statistics

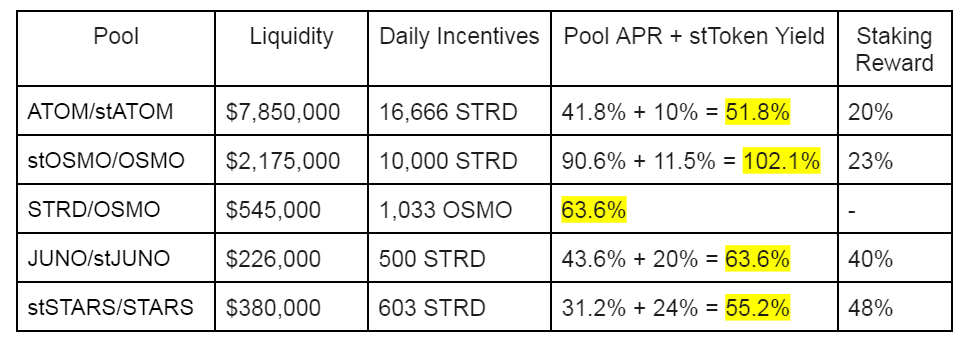

The following data is current as of December 7th, 16:00 UTC. Table shows the yield Stride's liquid staked tokens can earn when LPed on Osmosis compared with the normal staking reward. Looks like it's always more profitable to liquid stake and LP!

stTOKEN/TOKEN pools give constant 100% exposure to a single token, meaning they have effectively no impermanent loss. In terms of economic risk, providing liquidity for these pools is the same as staking - except LPing earns a much higher yield.

Pool Links

ATOM/stATOM: https://app.osmosis.zone/pool/803

stOSMO/OSMO: https://app.osmosis.zone/pool/833

STRD/OSMO: https://app.osmosis.zone/pool/806

JUNO/stJUNO: https://frontier.osmosis.zone/pool/817

STARS/stSTARS: https://frontier.osmosis.zone/pool/810

Stride Liquidity Pool Incentives Guidance

In order to be useful to DeFi applications, Stride’s stTokens need deep liquidity. Liquidity is incentivized with STRD and OSMO. Stride uses short-duration incentive gauges. Doing so provides more flexibility as opposed to long-term gauges. To be clear, Stride mainly wants the flexibility to easily add more incentives when necessary.

In order to give liquidity providers some assurance that Stride is committed to continually renewing its incentive gauges, Stride provides the following guidance:

1. If Stride wants to decrease the STRD per day incentive rate for any of its liquidity pools, Stride will always provide at least three weeks’ notice.

2. According to current expectations, it is highly unlikely that Stride will decrease the STRD per day rates for the stATOM pool or the stOSMO pool. Current incentives for those two pools are expected to be continually renewed for at least a year. Strategically, these are the two most important pools.

For an illustration of Stride's liquidity pool guidance, see this spreadsheet.

That's all for now! Follow Stride on Twitter for real-time updates.